🧠 SeaHorse Invest | AI-Driven Market Intelligence

In the pulse of global markets, where patterns hide in plain sight, SeaHorse fuses quantitative precision with AI-driven insight to decode market dynamics across U.S. equities, select digital assets, and biopharma innovation.

By blending machine learning, technical modeling, and fundamental research, we explore how data transforms into directional behavior — from Ichimoku-based momentum structures and GARCH volatility regimes to crypto–equity interplay and biotech pipeline catalysts.

Our mission is to uncover probabilistic edges—through rigorous, compliant market research that bridges science, simulation, and strategy.

Join the vanguard of AI-powered market understanding, where intelligence replaces noise and insight evolves from data.

Technical Insights & Machine Learning

Multi-timeframe scans (weekly, daily, 4H)

Pattern recognition and volatility mapping

Probabilistic breakout modeling

Focus: Structure • Momentum • Volatility

Multi-Model Stock Forecasting

Three-month probabilistic forecasts

Monte Carlo, Bootstrapped, LSTM, GARCH simulations

Confidence ranges and scenario mapping

EPS momentum and valuation integration

Focus: Probability • Scenario Analysis • Model Consensus

Crypto–Stock Interplay Tracker

BTC/ETH weekend-to-weekday transmission effects

BTC/ETH price correlations in crypto-linked stocks

Scatter plots, regression slopes, and volatility coupling

Cross-market signal propagation

Focus: Correlation • Cross-Market Dynamics • Transmission

Deep Dive: Bio/Pharma

Pipeline and competitive landscape analytics

Fundamental–technical hybrid modeling

AI-driven catalyst mapping

Risk-adjusted probability curves

Focus: Innovation • Fundamentals • Quantified Discovery

Our Focus

-

Technical Insights & Machine Learning

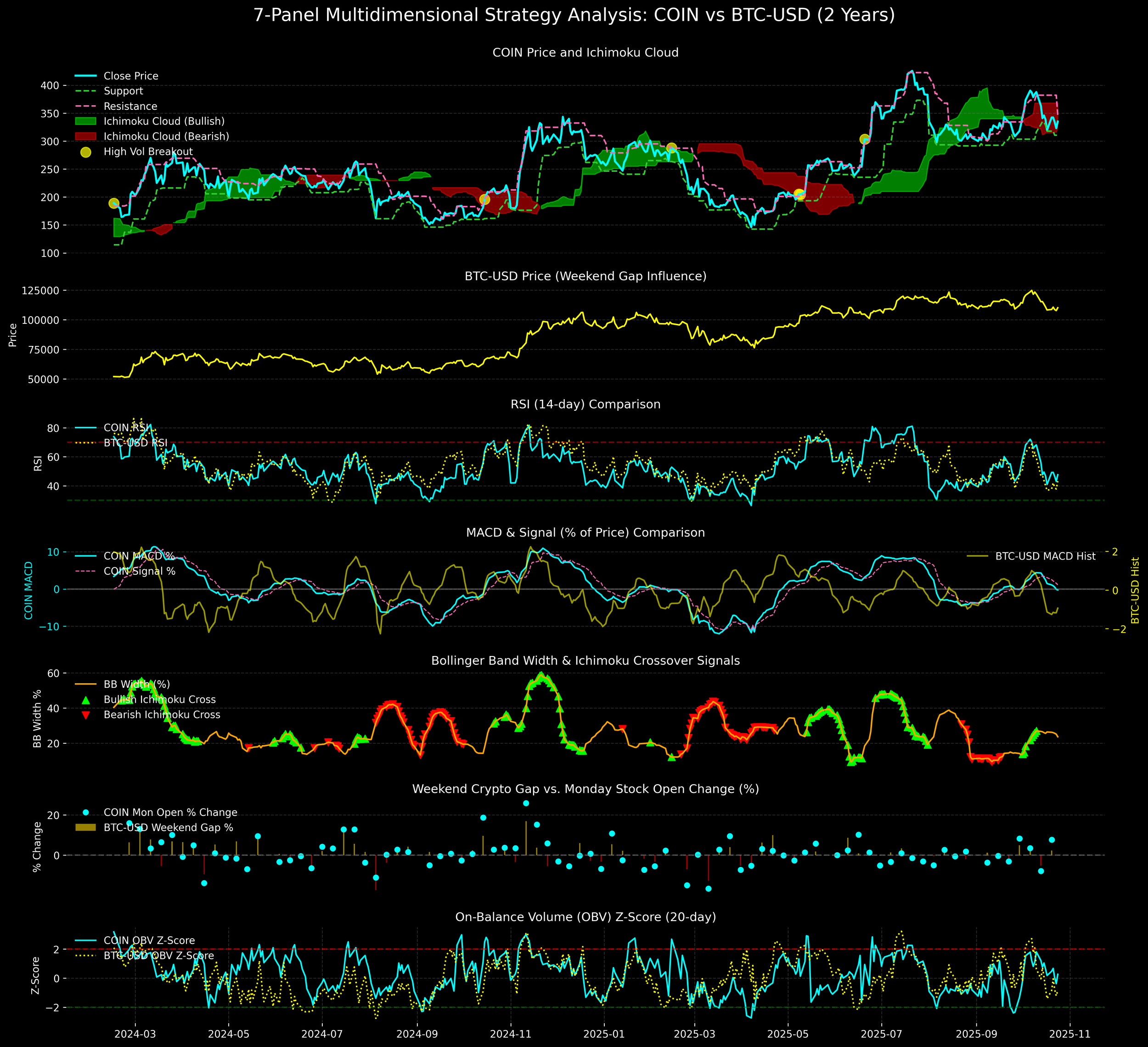

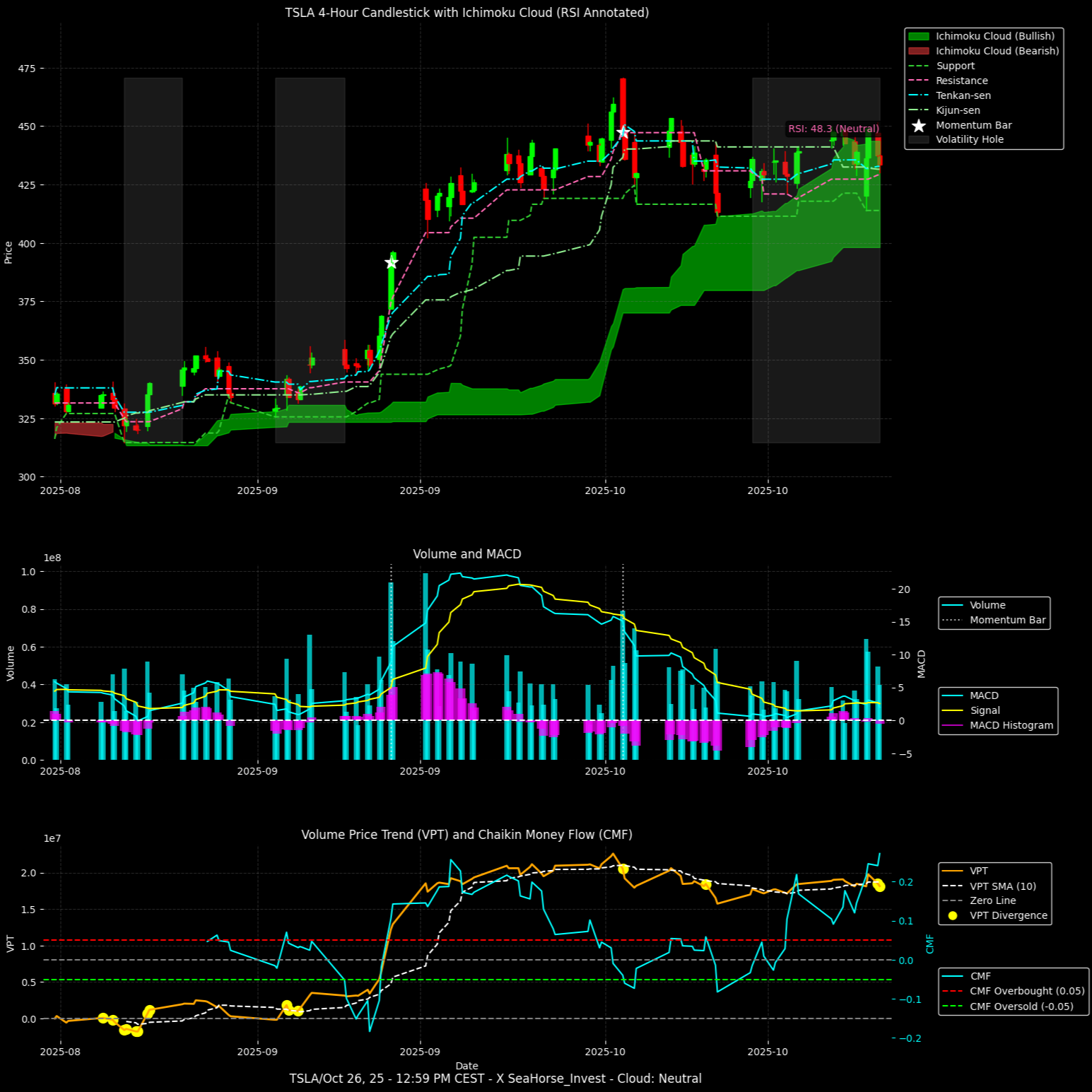

Our multi-layered market scans operate across weekly, daily, and 4-hour timeframes, revealing hidden confluences in high-momentum equities.

By integrating classic technical indicators—RSI, MACD, Ichimoku, VPT, and CMF—with AI-based pattern recognition, SeaHorse analyzes how momentum, volatility, and liquidity interact to shape market structure.

Each framework highlights support and resistance evolution, momentum divergence, and volume-driven inflection zones, providing quantitative context for understanding timing and risk asymmetry.

Our research demonstrates consistent breakout alignment within backtested conditions, reinforcing the value of machine learning–enhanced technical analysis for data-driven interpretation.

Explore custom research modules designed to map compliant pathways through volatility—where insight, not speculation, drives discovery.

-

Crypto-Stock Interplay Tracker

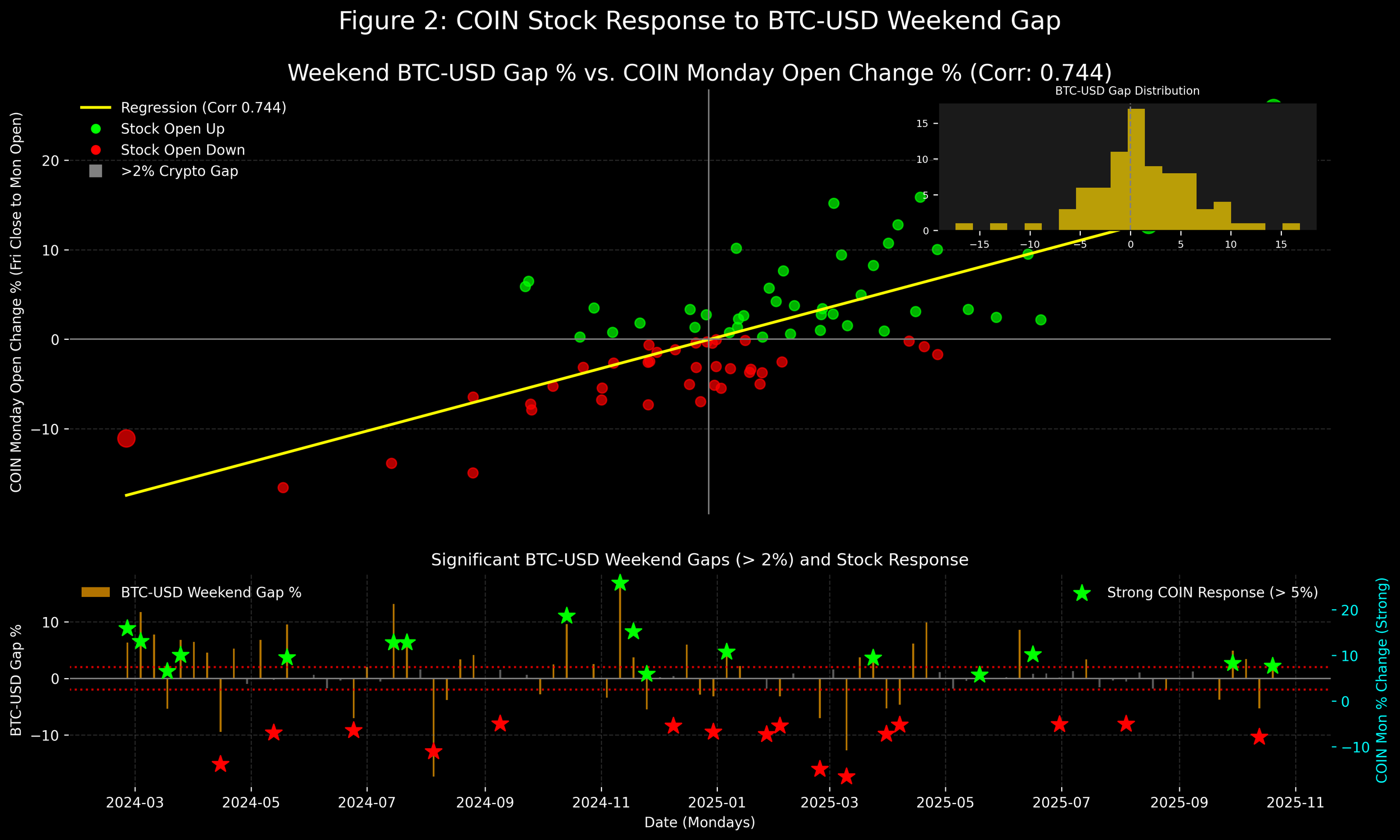

SeaHorse analyzes how crypto market behavior propagates into equity dynamics, focusing on mining, treasury, and exchange-linked stocks such as $COIN and $MARA.

Our research reveals pronounced weekend-to-weekday transmission effects, where BTC/ETH price gaps often shape Monday equity openings and fade as the week progresses—most evident during high-volatility “crypto summer” phases.

For example, quantitatively, a 0.74 correlation (≈1.00 slope) links BTC weekend gaps to Coinbase stock’s Monday performance: gaps exceeding 2% correspond to an average 6.5% equity move (≈87% upward), rising to 8.1% for >5% gaps (≈82% positive sessions).

These relationships, visualized through scatter plots and probability histograms, illustrate how cross-market volatility creates asymmetric opportunity zones.

Our ongoing studies transform these findings into data-backed frameworks for understanding crypto–equity coupling, helping to contextualize and capture the volatility without implying directional advice.

-

Multi-Model Stock Forecasting

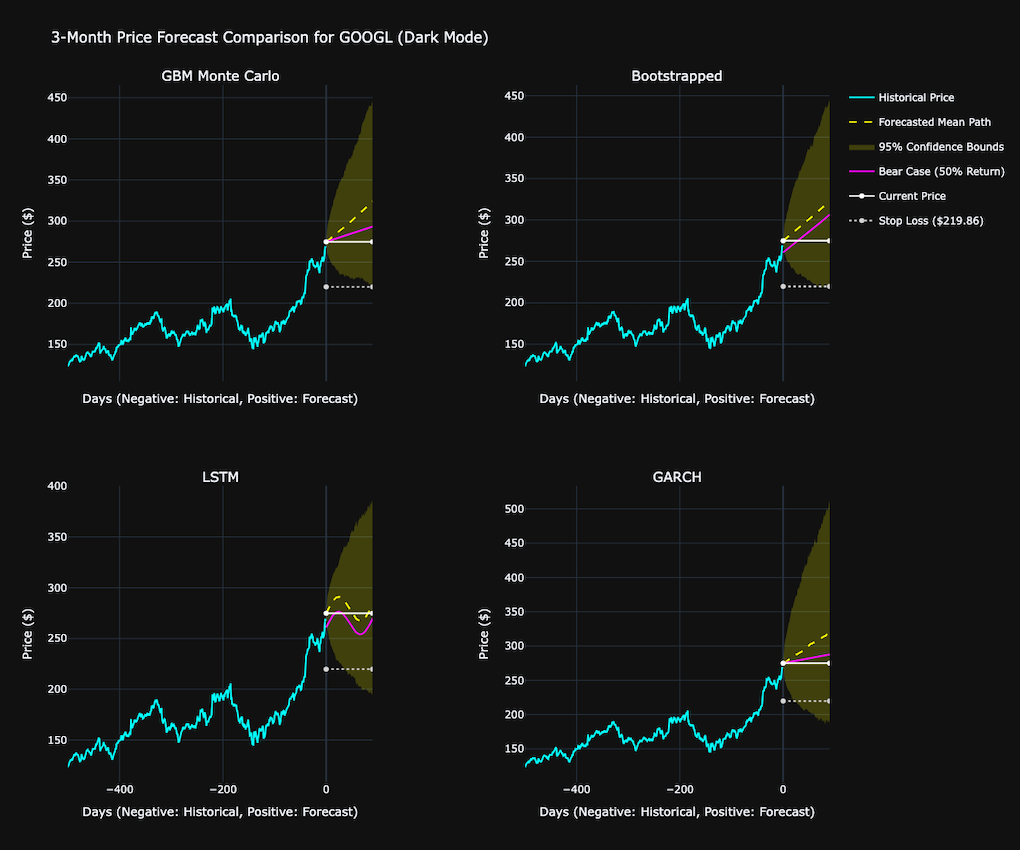

SeaHorse Invest develops AI-driven forecasting frameworks that generate precision 3-month outlooks for select, high-conviction equities.

Each model integrates historical price behavior, earnings-momentum trends, and valuation dynamics to construct probabilistic market trajectories—eliminating subjectivity and emphasizing empirical clarity.

Using ensemble simulations and Monte Carlo-style scenario mapping, our research visualizes potential pathways that balance upside probability against volatility exposure, highlighting where data convergence suggests meaningful inflection zones.

Results are presented through confidence ranges, risk-adjusted distributions, and multi-model consensus metrics, designed to deepen understanding of market structure.

This methodology offers data-backed insight for analysts and researchers seeking to interpret market uncertainty through quantifiable probability.

-

Deep Dive on Bio/Pharma

Deep Dive Bio/Pharma explores one of the market’s highest-stakes frontiers—where paradigm-shifting therapies can deliver exponential value amid equally significant uncertainty. Our research dissects leading biotechnology and pharmaceutical companies with forensic precision, combining scientific context, fundamental strength, and competitive positioning to illuminate pipelines, opportunities, and milestone-driven catalysts, balanced against dilution and execution risks.

Layered with machine-learning-enhanced, multi-timeframe technical analysis—integrating Ichimoku cloud dynamics, RSI/MACD divergences, and volume-based confluences across weekly, daily, and 4-hour frames. SeaHorse models probabilistic breakout behavior through backtested scenarios and historical performance distributions.

These studies provide quantitative context for understanding how innovation cycles translate into market movement. The objective is map the deterministic landscape of biopharma equities through rigorous, data-driven research.